Evolution or Revolution & Thoughts on Market Timing

By Arie van Gemeren , CFA – Principal @ Rising Tide VC

In November 1790 the great English Statesman Edmund Burke published a pamphlet entitled “Reflections on the Revolution in France”. Known to this day for such quotes as “the only thing necessary for the triumph of evil is for good men to do nothing”, Edmund Burke was also an implacable conservative and member of the Whig Party who vehemently opposed the French Revolution in all its forms. The basis of his argument was that the English system was superior in that it had evolved, rather than sprung from a revolution, and that abstract and radical ideas did not care to concern themselves with the actual work of providing “execution” of their ideas. As he says, ‘What is the use of discussing a man's abstract right to food or to medicine? The question is upon the method of procuring and administering them.”[i]

England, in other words, had not

developed a system from “abstract ideals” but rather from a gradual evolution

of their political processes, building upon what had come before to build a

system that “worked for the English”, versus “was beautiful in theory”.

So how does this relate to VC & Tech Investing? In today’s world, our duty as venture capitalists, and the duty and mission of entrepreneurs, is to span this divide and seek the right balance in researching, diligence-ing and ultimately investing in new opportunities. A lot of ink has been spilled on this – such as Peter Thiel and his thoughts on 0 to 1 versus incremental improvements.

Basically, I would question it this way – is a 0 to 1 movement (a “game-changer” kind of company) a “revolution” in thinking and technology and a “blowing up” of what has come before (like the French Revolution) or is it rather an Evolution in the Burkian / English sense of the word. To me, it seems that we over-use the word revolution and should instead spend our time both assessing the opportunity but also the macro-forces in the market more broadly that may enable the solution. For instance, the smartphone seems revolutionary and ushered in a huge array of new technologies and businesses, but in retrospect, it alone was really a culmination of previous technologies and advances. The market was prepared for it. The opportunity to have an all-inclusive smartphone evolved from existing technologies, cultural norms and perhaps battery life too!

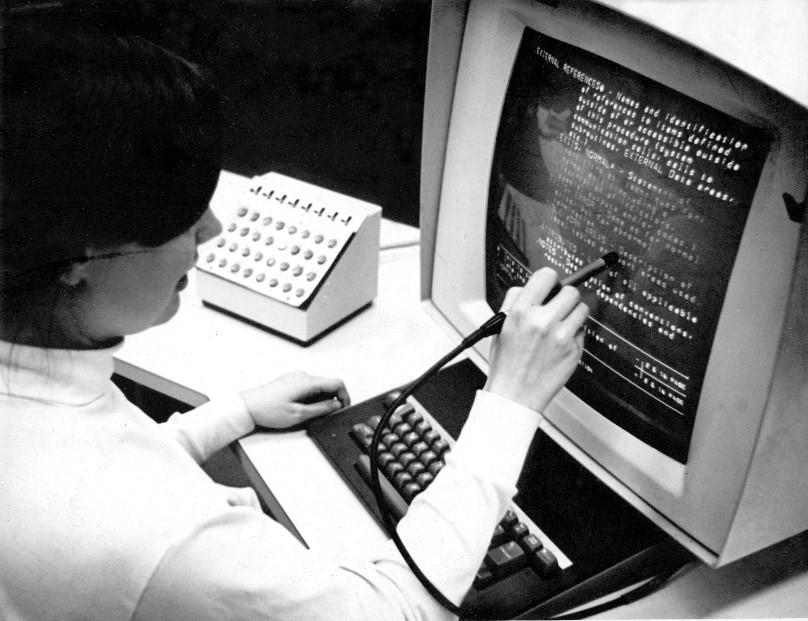

There are many cases, though, when the underlying fundamentals are just not there. Take a concept – pen computing, for instance – which came before its time. The result – for entrepreneurs and for investors alike – was a lot of carnage along the road, and little success to show for it. But such is the process of development of “new” technologies. As Marc Andreessen stated;

Take pen computing. When I got to the Valley all the VCs had just gotten their heads handed to them on pen computing, including Apple with the Newton. The Newton in 1989 and the iPad in 2009 are essentially the same product just 20 years later, with 20 years of advances in software and hardware, but the same basic product.[ii]

Or, for instance, anybody who sells to or purports to disrupt sclerotic old-line industries that may be opposed to real innovation (insurance, for example, or even Auto OEMs – who are interested in technology but may take far longer to approve a product than a business can remain solvent). A revolutionary idea which will ‘take everything by storm and upturn the old order’ requires the acquiescence, in some cases, of the old order. Or, it must have had its way paved for it by cultural adoption or regulatory changes that enable the new idea.

And another example - why did Facebook triumph after scores of social networks already existed (remember MySpace?), or better yet Google when the prevailing wisdom at the time was that the search engine thing was done and there were hundreds of other search engine algorithms. Did you know that when eBay was coming to market, there were already hundreds of online auction sites available?

It seems that the supporting technology needs to be in place for a new idea, a new business, or a new technology to really take the market by storm. The concept of Google Glass is brilliant, the execution less so. The concept of pen computing was tremendous (after all – what has more historical “proving” power than using a pen?), but the first computing pens had wind-up cranks and ran for ten minutes! The list goes on.

In other words, it seems that revolutionary products are only perceived as revolutionary and must build upon other existing technologies. In fact, the proving process for an idea or a concept can probably be traced through the previous decade or more, and in many cases even longer. The iPhone came to be because of decades of work on handheld devices, of market acceptance of the Walkman to listen to music and was a combination of many disparate ideas that already had an established place in the market. Steve Job’s brilliance was to combine them and create something new, and yet not new, that could readily be accepted into the market. Thus, today, we are presented with what I view as antiquated industries in need of “reformation”. Take insurance, for instance – an incredibly vital function for a properly functioning economy and society (what risks could one conceivably take without this important feature)? Many less, is the short answer. And yet, do we blow everything up and start anew – rethink the industry, or focus more on execution and building upon what has come before?

Blockchain Technology, with all its promise, appears at face value to be more of a revolution. But I imagine that, in time, blockchain will come to be perceived as a logical step forward in technology and will be less about “disintermediation” and more about “evolution” of an existing system that can continue to grow forward. But even at this – disintermediation of intermediaries has been happening for quite some time, so from a social / cultural perspective the concept behind Blockchain Technology isn’t even a radical leap forward. Society, technology and business have evolved into their current form over literally thousands of years – it seems likely that this process of evolutionary growth will continue to be the norm, and a safer investable theme, than the newest and most revolutionary “gap upwards” opportunity.

Here’s one counter-point I think some might throw back at me. Uber, Lyft and Airbnb are all revolutionary concepts that are working to fully disintermediate existing businesses. They also blew up the existing order of things – aha! A revolution you say! Revolutionary concept! Down to the existing order, and up with the new!

Perhaps – but in this case, safely supported by massive public adoption of smartphone technology, and cultural adoption of phones for a variety of applications and uses. But what if Uber had come before the smartphone, and the means to get your quick and ready cab had been to get to a payphone and it connected you automatically to a driver who was wielding one of those enormous Jurassic Park (first one) cell phones n their car? I bet it wouldn’t have worked. One could also argue that the success of Uber and Lyft, specifically, was also driven by consumer’s growing understanding of how bad their current options were – in everything! In buying cars, in insurance, and much more.

Said differently – what if I proposed a revolution in the gold industry. We’re going to utilize technology (it’s all around and exists) to go to outer space and harvest gold in massive quantities from asteroids. It’s there, we can get there (we know we can) and we are highly confident there is a LOT of gold out there. But this is a MASSIVE leap forward. Like enormous – way beyond anything ever even conceived of. In such visions there lie enormous profits, but also enormous pitfalls that all but guarantee the initial movers in this space are probably not the ones to harvest (pun intended) the benefits. The market (in my opinion) is just not there – it’s too big of a leap forward. And so this idea would be an actual revolution – it’d destroy terrestrial gold mining companies and holding groups (not to mention – this asteroid out there with quadrillions of dollars’ worth of precious metals – has anybody considered what that would do to the actual price of those metals on earth? You’d have to carefully meter out the metals harvested, which probably makes the whole thing totally un-economical anyways!). It’s often stated that when evaluating an investment, one should consider a) the jockey (aka the founder and the founding team), b) the technology and its feasibility, and c) the business plan, strategy, competition and market size! We agree with all of these but think that a key and important question to ask is – is the time right, and more importantly – does my entrepreneur understand the market from a deep, ground up level, and does my entrepreneur believe the time is right. And if so, why?

[i] Edmund Burke, Reflections on the Revolution in France[1790] (Pearson Longman, 2006), p. 144.