Technology and the Emerging World

We just returned from a week-long trip to Mexico City to celebrate and attend the Google Launchpad opening week, and what an amazing week it was. We’ve been spending a lot of time in Mexico (Ciudad de Mexico, or CDMX, to locals). A core question we heard again and again on our week there was this – what does it take to build an ecosystem whereby technology and innovation can flourish? Said differently – what elements are necessary for an ecosystem to flourish, and for homegrown innovation to “erupt”? As an investor, you might also ask – when is the time right to start investing in a market? The world of technology startups / eco-systems is fraught with tales of “the timing not being right”, so there’s no perfect answer to anything, but here’s my attempt to decipher what you need to thrive, and why there (to me) seems to be so much opportunity outside the US / Canada / Europe.

Our Firm prides itself on having a deep and rich network of investors and partners across the world (primarily outside the US, with the fortunate few US investors joining us as well). We have always had strong relations and networks in the Middle East, and since joining the Firm we have really pushed our engagement with Latin America as well. It’s the culmination of a dream for me – my family fled Germany before World War II and settled into South America, and Spanish was a common language in my household, as was the culture and appreciation for the people.

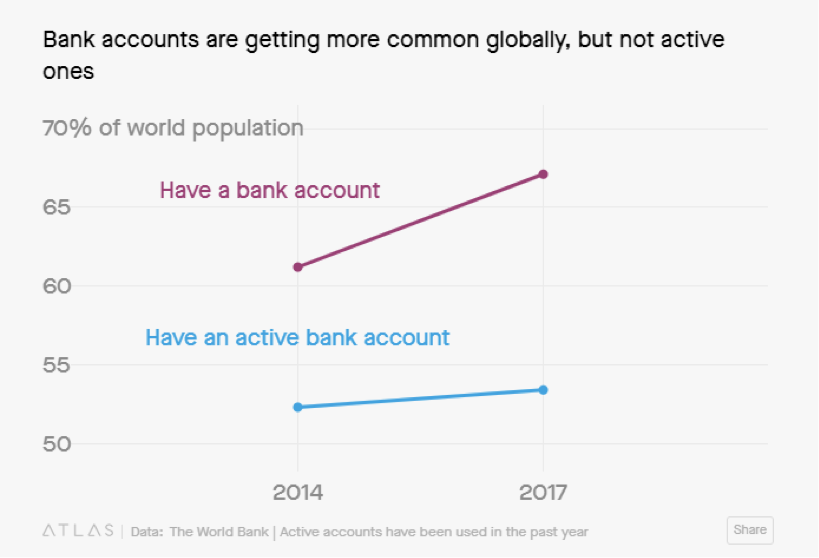

Technology can be a double-edged blade. It can be used to help authoritarian regimes expand their control and monitoring of dissidents, and/or to create a dystopian future like a Black Mirror episode where everybody gets a social ranking. But it has enormous power to liberate and change the world, and these countries, as well. For instance (below) – banking the unbanked, providing micro-lending, using drones to get supplies and medicine to rural places, social network engagement to rally popular engagement and overthrow dictators, and much more. Dictators and tyrants have more to fear from a connected and united people than they do from foreign nations – and innovations have made this possible. As a Fintech investor, myself, the potential for financial technology to dramatically improve the lives of the underbanked and underserved is enormous.

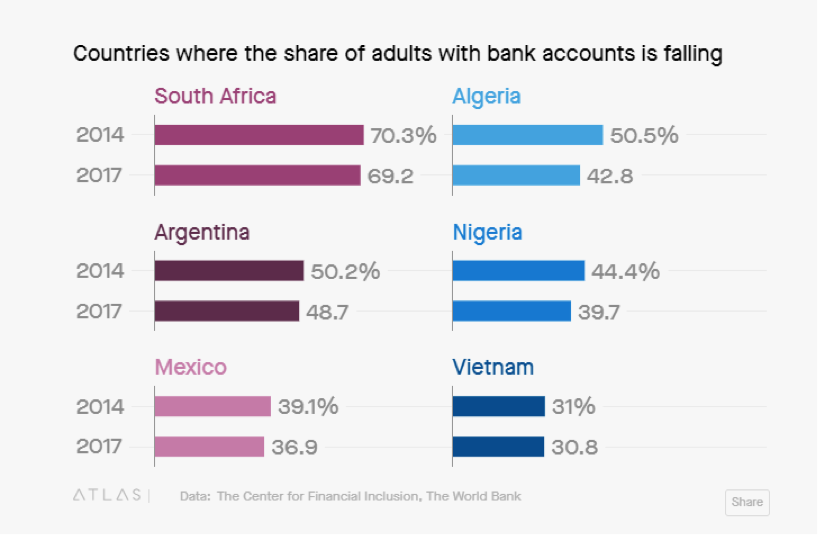

Being in Mexico, and meeting with major operating families, gave me a small glimpse into the scale of opportunities in Mexico specifically, as well as the challenges that we here in the US may not even realize. For instance – my favorite anecdote – was talking about the lack of easy to access investments. I remarked, in shock, that there is not really a Schwab or Fidelity counterpart in Mexico which provides easy and inexpensive investments to the masses. How, I wondered, were people to grow their money over their lifetime and have enough for retirement? Our generous hosts laughed, lightly, and informed me that over half of people in Mexico don’t even have a bank account. Let’s take a step back, Arie, before we start discussing Vanguard Index Funds and investment options available to the masses. Let’s just bank people!

Setting aside my naivete, it did get me thinking. Not everybody in Mexico has a bank account, but everybody there has a phone! Take a look at Nigeria, and you can get a glimpse at the opportunities inherent in such economies. It is clear that “mobile” has gained mass adoption way faster than simple banking, and as such the way their economies will develop may be markedly different from how the US has developed. That should be clear, and apparent, to any casual observer. A lot of ink has been spilled on the mistakes that some well-known major economies have made trying to rapidly fund aggressive growth like the US experienced during industrialization. Why should cities be built from scratch like they exist here, for instance? Perhaps there’s a better way if you could do it over again?

On this (completely) tangential note, we had this incredible conversation about architecture. Everybody builds US style skyscrapers. Why? They make a lot of sense in NYC, perhaps, but do they make sense in the Middle East? Local architects in the M/E have begun designing their own style of architecture, to meet their own needs. For example – the below towers were built in Abu Dhabi with rotating sun shields to keep air conditioning costs down. Innovation and need can be local, and can be profitable too!

We had the chance to meet with several talented entrepreneurs while we were down there. As we know here, the dearth of engineering talent is a huge problem. I asked if this was an issue for them. The answer was – not at all, there is a tremendous amount of talent spinning out of Monterrey’s Technical School and from Mexico City as well. But graduating engineers into the marketplace isn’t the only condition – though it’s helpful!

This leads to what I think is the more interesting / harder to argue with argument, which is that the “culture” of “this place – aka Silicon Valley” is unique and can’t be replicated. People here have a unique desire for risk, and our culture has evolved in such a way that not taking a traditional job with W-2 income is a good thing, while elsewhere in the world it is looked upon with horror / shock. Perhaps that’s true. I’d argue it’s true here in the States to a great degree, too. I’d also argue that some of our most robust and talented entrepreneurs were not born here! So then maybe it’s a “geography” thing, and being here is the key. Or is it a different set of factors?

Here are a few I think are super important if you want to invest abroad, think about investing abroad, and/or help build an ecosystem:

- Regulatory Infrastructure: hear me out – regulation can be good! We have a strong regulatory regime that makes investors more comfortable (in general) with taking on risk (side-note – any Mexican startup seeking US capital is almost always a Delaware corporation. What a business Delaware has built for itself, that non-US companies are incorporating there as well!). But guess what – regulation and law can be a benefit for a society, and Mexico recently passed laws overseeing its own Fintech industry. So there you have a component.

- Access to Capital: startups need access to capital. Not just seed capital (or accelerators), but capital sources capable of holding a company over as it grows, expands, and builds into the future. The amount of money flowing into Latin American startups now, plus the number of Firm’s opening Mexico focused investment arms, are truly staggering. Softbank is even getting in on the game! But more broadly – you need access to capital from the earliest stages, through growth, to exit opportunities – if the chain gets broken, firms can die. It was eerie to hear, at the Launchpad event, a Brazilian entrepreneur relate how several years back they had to basically lay off half their staff and cut cost extensively because the market was in a recession and they were told there was NOBODY to fund them (at all). This seems to be alleviated somewhat in the US – a great business should be able to find funding (eventually) – but it takes a serious issue for funding to completely dry up. This is more common in more shallow capital markets . .

- Access to Mentorship: broadly defined . . . but senior mentors and leaders who can help younger founders learn and grow. Google Launchpad is a great step in this direction. I was reminded of this when visiting Portland, OR recently and hearing that the lack of “exits” in the market was hurting the market a little bit in that more experienced founders didn’t exist in the marketplace to write angel checks and help newer teams (don’t worry, Portland, I too believe your time is coming soon).

- Trust!: as anentrepreneur,you really need to trust the ecosystem and one another. The proliferation of capital sources means that entrepreneurs will gain the upper hand in negotiating deals, and will therefor form truer partnerships with investors in the future, which should have a positive impact

One last note. I really enjoyed Bill Draper’s book, The Startup Game, and gleaned a lot of useful ideas from it. The Draper’s have been responsible in their own way for expanding the VC game across the world, and empowering entrepreneurs, so I trust Bill Draper when he says that a major research university is a necessary condition and factor for the development of innovation and tech. Monterrey, in Mexico, has this condition, as does Mexico City and other hubs.

I think the timing is now for great innovation and opportunity to arise in the emerging world, at large. And the opportunity exists, so we believe, to help US tech firms access the immensity of talent, opportunity and people in these lands as well. It’s more than an investment thesis for us, it’s a belief – the future is global.

https://www.ozy.com/fast-forward/the-rise-of-mexicos-high-tech-entrepreneurial-generation/86434