Platform Banking

I’ve been really intrigued by this notion of “Open Banking” over the last few weeks. Everybody is getting in on the discussion. The Economist ran a great series on “Tech’s Raid on the Banks” which I thoroughly enjoyed, and went into detail on Asia and the UK – two markets where barriers are being broken down and FinTech incumbents are starting to eat away at market share. It would seem logical that Open Banking is bound for the United States, too, except that banks in the US are quite opposed to it and the current Administration seems unlikely to break ranks with major banking institutions.

The US is a unique animal. Banks are hidden behind a thicket of regulations that make many of the stand-alone “neo-banks” in Europe and Asia all but impossible here. For example, there are two regulatory authorities in the United Kingdom that were required to implement open banking. By contrast, there are eight (8!) Federal Agencies, plus the regulatory authorities in each State. The US system has evolved quite uniquely over time, as power has shifted between states & the Federal government – all resulting in a tangled, confusing mess. Power to the major corporations in this case, I suppose. Which is ironic, given how much businesses complain about regulation – but there’s something to be said for regulatory walls!

Beyond this (herding regulatory cats) – the US banking system is SUPER diverse. What if banks came together and created some sort of communal system for open banking? Seems tough, because of the tens of thousands of local and community banks that probably wouldn’t join in and do a fair bit of the banking in the United States.

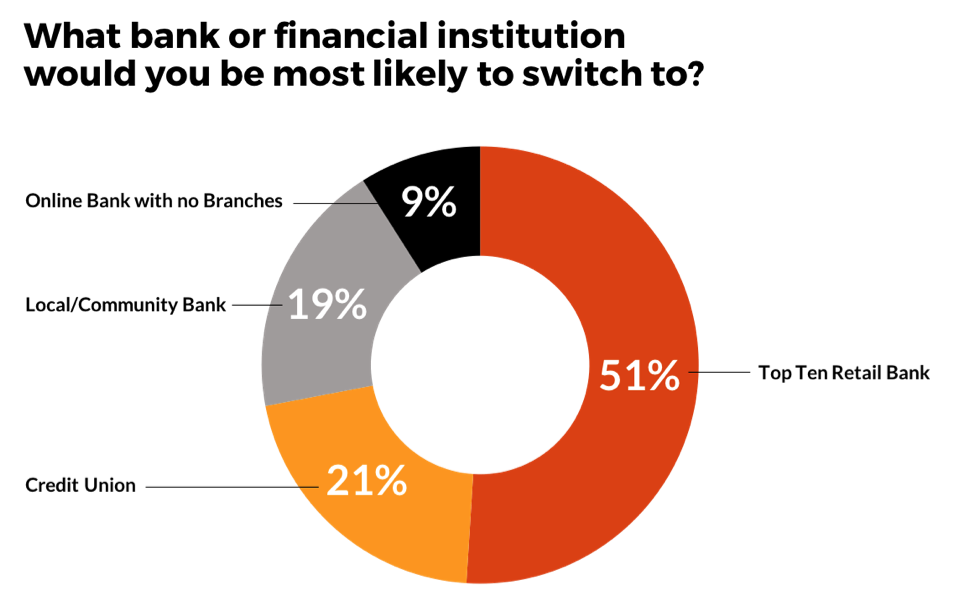

More-so – why would open banking be in the interest of banks? After all, as this Forbes article astutely observes – data is the new gold, so why give it away for free? And yet, we (the royal WE – the United States) is undoubtedly behind the curve in the advancement of the financial services business. As the UK demonstrates, it’s possible for stake-holders to come together and create something in consumer’s interests that also creates unique value for end-users. What I find interesting is this graphic – people are really unhappy in general with their banks, and such banal costs as overdraft fees, checking account fees, and more. But they’re mostly thinking . . . of going to other retail banks. That’s interesting to me – they are dissatisfied with banks, and mainly want to go to other banks. What does this say about the state of credible alternatives in the United states to major banking institutions?

Source: http://cg42.com/publications/retail-banking-vulnerability-study/

There are advantages (and disadvantages) to our current system of banking. For one – it’s relatively easy! You get to go to one place to deal with everything. I personally bank with Chase, and like having one person to call for literally all my needs (so many needs . . . not really). But seriously – vertical integration has its pros. Then again – is it truly preferable or just a habit? After all – banks often are the ones telling us that vertical integration is in our unique benefit.

You uniquely benefit from our vertical integration and scale. Stay with us . . . forever.

Take insurance. I recently refinanced my life insurance contract from State Farm to another firm through HealthIQ. I used to do all my insurance business through State Farm (Auto, Home, Life, etc.). But what I failed to realize is that by aggregating all my business with one provider, I was in fact subsidizing a lot of other people. By contrast, I was able to get twice the life insurance coverage for the same amount as HealthIQ has created quite the niche in serving only a very healthy clientele and thereby reducing our coverage pool. (Left quite unsaid here is . . . if you extrapolate this trend out . . . it’s unsustainable, as somebody has to support sick or unhealthy people on health insurance or life insurance, or else . . . they can’t be insured!).

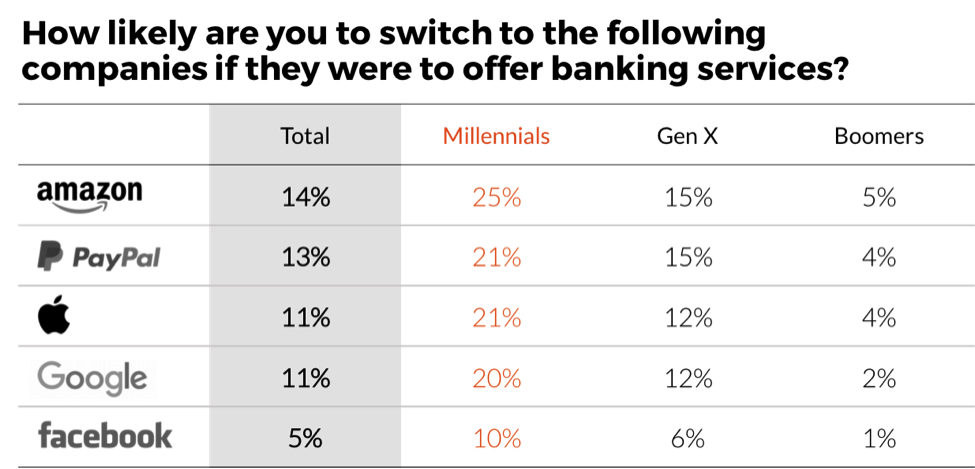

Anyways – some forward thinking organizations have opened up their code to outsiders to tinker with. Clearly, such organizations have their own profit motive in mind, and yet it’s a start. Which leads to my argument for why banks should probably open themselves up and collaborate / create platforms. Check this graphic out.

Source: http://cg42.com/publications/retail-banking-vulnerability-study/

Point being? There are real dangers to being behind the curve, and US Banks are behind the curve, and a major US Technology player who is majorly trusted (like Amazon) could be in a credible position to seriously threaten US Institutions (by contrast, FinTechs cannot – at present – do it, but they could partner with banks to create superior service for clients!). After all, banks produce a “product”, and there is a world in which they are disintermediated from the end customer. It’s happening all over the world right now. Amazon already owns customer relationships on a deep level – imagine if Amazon somehow moved themselves into owning customers themselves, and disintermediated the bank and forced them to “sell” through their platform to you. Here’s a telling statistic from The Economist.

“In retail banking 70% of share-holder value is typically captured by the customer-relationship and distribution channel, and just 30% by product manufacture, says Jan Bellens of EY, a Consultancy”

To avoid this unenviable fate of being forced to sell through somebody else’s marketplace, imagine instead this scenario. You bank through a major retail bank. That major retail bank opens up their APIs and customer data to third party developers and create an “app store” for clients which allows the most innovative and interesting ideas to be utilized, and potentially allows the distribution of other product through their front-end client owning portal. Some ideas this might unlock, for instance;

- Point of sale lending! Why not? Outside developers can utilize data form the banks, plus data from your phones, to create the opportunity to seamlessly underwrite, risk adjust and offer you a loan

- Faster and more accurate life insurance? Why not? Access to your data and information in a way that can perhaps produce underwriting improvements and a better evaluation of your lifestyle!

- Improved Payments infrastructure – Zelle is this amazing example of all the major banks coming together, and it still taking YEARS for adoption to pick up, the right team to come through, and more. I’ve always thought that entrepreneurs with limited capital, limitless hustle and a desire to succeed will outperform most corporate backed and funded innovations . . . I am sure there’s counterpoints, so send ‘em! More broadly, though – why do businesses still need to use a merchant account? Why couldn’t some innovative player cut the middleman out completely and significantly reduce costs for merchants?

- Customer-facing AI driven capabilities that can improve service, suggest new services, and/or significantly enhance existing ones

- So many more for entrepreneurs to figure out

In short, the time for platform banking (though perhaps not OPEN banking per se) seems nigh. And even behind its regulatory thicket, banking is still at risk. One has only to look @ China, Europe and almost everywhere else in the world to see that with technology, banking institutions are at risk unless they take proactive efforts to get ahead of the curve and start delivering unique, new value to clients.

Perhaps, just perhaps, that would require a shift to platform banking, and a little bit less control.