Molecular Assemblies Closes $26 Million Series B Financing to Advance Enzymatic DNA Synthesis toward Initial Commercial Access

By Brent MacDonald – Principal @ Rising Tide VC

Molecular Assemblies is a life sciences company developing an enzymatic DNA synthesis technology designed to power the next generation of DNA-based products. The Company’s patented enzymatic method, based on making DNA the way nature makes DNA, produces long, high-quality, sequence-specific DNA reliably, affordably, and sustainably.

Scientists at Molecular Assemblies have developed a Fully Enzymatic Synthesis™ (or FES™) technology that produces highly pure, sequence-specific DNA on demand. This two-step proprietary process uses aqueous non-toxic reagents, requires minimal post-synthesis processing, and can scale to longer DNA sequences. FES technology was specifically designed by Molecular Assemblies to overcome the substantial limitations of the current decades-old chemical DNA synthesis process, known as the phosphoramidite method. With longer, purer pieces of synthetic DNA, FES technology from Molecular Assemblies is designed to streamline synthetic biology applications and meet significant customer demand for faster turnaround times and reduced error rates.

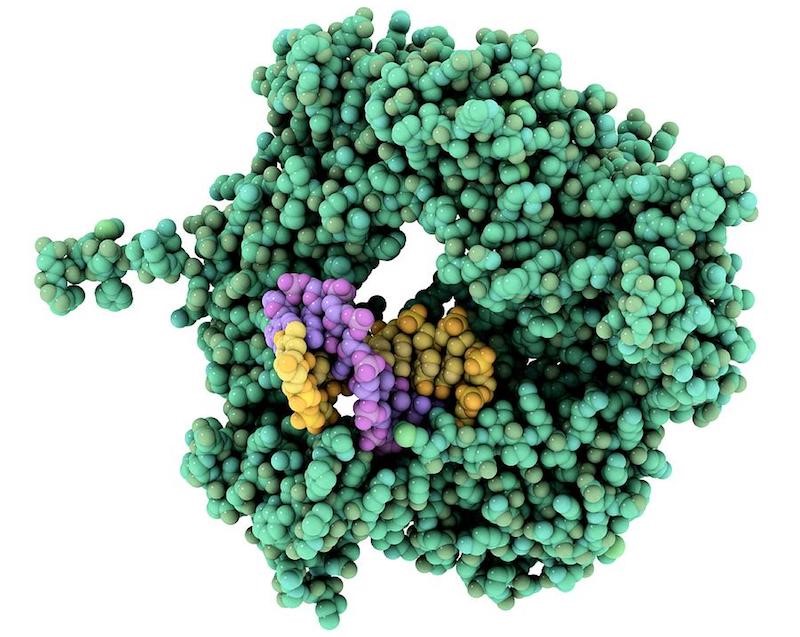

Codexis, Inc. (NASDAQ: CDXS), a leading enzyme engineering company enabling the promise of synthetic biology, and Molecular Assemblies announced the next phase of their partnership with the execution of a Commercial License and Enzyme Supply Agreement, enabling Molecular Assemblies to utilize an evolved terminal deoxynucleotidyl transferase (TdT) enzyme in Molecular Assemblies’ Fully Enzymatic Synthesis™ (or FESTM) technology. The companies collaborated to develop this supercharged TdT enzyme to advance fully enzymatic DNA synthesis for the production of long, pure, accurate oligonucleotides to accelerate innovation in many fields. Molecular Assemblies plans to first make its FES™ technology available via an early access Key Customer Program, opening later this year. This program is expected to enable researchers to accelerate their research for gene editing, including CRISPR technologies, next-generation sequencing (NGS), and gene assembly applications.

Molecular Assemblies recently announced that it closed $26 million Series B financing and proceeds of the financing will be used to advance the Company’s proprietary enzymatic DNA synthesis technology toward early commercialization efforts.

Why we are excited?

In just three steps, Molecular Assemblies enzymatic process is simple, seamless, and sustainable. Unconstrained by scale, format, or platform, Molecular Assemblies’ enzymatic synthesis process is broadly applicable across new and emerging industries.

Synthetic DNA is used in a wide range of applications, including life science research, biologic therapeutics and diagnostics, data storage, nanotechnology, and industrial processes for agriculture, plastics, fermentation, and bio-materials, such as leather or spider silk. However, the full potential of synthetic DNA has not been realized due to the cumbersome process of chemical DNA synthesis. The current, three-decade-old method for chemically synthesizing DNA is inherently limited to relatively short DNA sequences, requires extensive post-synthesis processing, and uses hazardous chemicals. Scientists at Molecular Assemblies have pioneered a three-step enzymatic DNA synthesis process that can deliver highly-pure, sequence-specific DNA on demand, without a template, and can scale to longer DNA sequences.

DNA synthesis is a growing and potentially booming space, much like DNA sequencing in the early 2000s. We believe Molecular Assemblies’ approach in developing an enzymatic method, alongside its skilled team, makes it a compelling investment. Its potential to integrate into other DNA synthesis hardware platforms can also provide additional avenues for value creation.

The Future is in Our DNA!

Read Series B press release here.

Rising Tide Fund Managers, LLC and its affiliates (“Rising Tide” or “We”) is a United States venture capital firm investing primarily in the information technology and healthcare/life sciences markets. Over the last 35 years, we have partnered with family funds, high-impact investors, and strategic partners to help launch and expand startups in a variety of industries across three continents. We are dedicated to cooperating with our entrepreneurs at all stages: from financing to leveraging our international networks to facilitating exits by design. For more information, visit www.rtf.vc.

The portfolio companies described herein do not represent all the portfolio companies purchased, sold or recommended for portfolios advised by Rising Tide. The reader should not assume that an investment in the portfolio companies identified were or will be profitable. Past performance is not indicative of future results. Investors should be aware that a loss of investment is possible.