Financial Inclusion & Opportunity

I read this NYT Piece this week and it got me thinking that the world of fintech and financial inclusion are definitely something which is coming of age. Just to address the piece, though – I think the author has chosen a few choice examples to contradict accepted wisdom, though it doesn’t (to me) really debunk solid financial advice. The core tenets of “saving”, and then “investing”, and “not going into debt” and “paying off high-interest debt first” are probably great working principles for most Americans (indeed, for most people). The Richest Man in Babylon is a great, old read on these topics – most of that has changed. And yes … I know … it’s not actually from Babylon.

One theme I’ve seen time and again is that financial technology has the potential to elevate the poor and underserved by delivering access to the means of capital, as well as financial education. The second topic is important in one major way – we, as a country, are financially illiterate. I have only to think of my own life, growing up, and having almost zero education on stocks, investing, savings, etc. Now the conditions were there for me to learn, and I eventually taught myself, but I can credit my family and environment for a LOT of that. Most people don’t have that.

Thus, there’s a push by a lot of great FinTech startups to tackle this issue. Empower Finance, for instance, is an online bank coupled with a recommendation and advice engine built into it. Examples abound – interest rates are done, have you considered refinancing? You’re not earning very much in your savings account, have you considered this? So on so forth. One issue I’ve heard repeatedly is the prevalence of payday lenders in minority and/or poor neighborhoods.

Let’s talk about Payday Lending for a second. Definitionally … Payday loans are basically cash advances on our paycheck, along with a healthy service fee and interest, that is usually due 2 weeks later along with your paycheck. They’re super expensive. The “national average annual percentage rate (APR) for payday loans is almost 400%”. And there’s no denying that this ‘service’ falls heavily on certain communities in the United States.

Combating Payday lending is really a matter of education, as well as an issue of options. Why do people take payday loans? The issues and reasons vary. But at its core, the reason probably comes down to bad spending habits (education) and the fact that there’s nobody else willing to extend credit. Now there’s an important and interesting point. Unwillingness to extend credit is a major issue for underserved groups in the United States – and the manifestation can be seen in different guises. One might be the strength of payday lending. Another is that credit to SMEs could be used to help create jobs in minority communities, where those businesses are likely embedded and would like to grow.

Some companies, like Listo Finance, aim to provide financial services to specific minority groups within the United States. In speaking to this company, for instance, we learned just how many people want auto-insurance or other protection but don’t feel like they have access via the current system (perhaps they want to pay in cash). Plans include launching life insurance and other options. I’ve spoken about this before, but insurance is the ultimate hedge – the comfort one feels in knowing that if the breadwinner of a family dies that their family is taken care of cannot be overstated. Or that if their only means of getting to work (a vehicle) is wrecked, it won’t financially ruin them (and prevent them from getting to work)! Imagine the productivity that could be unleashed if people can free themselves from financial fear?

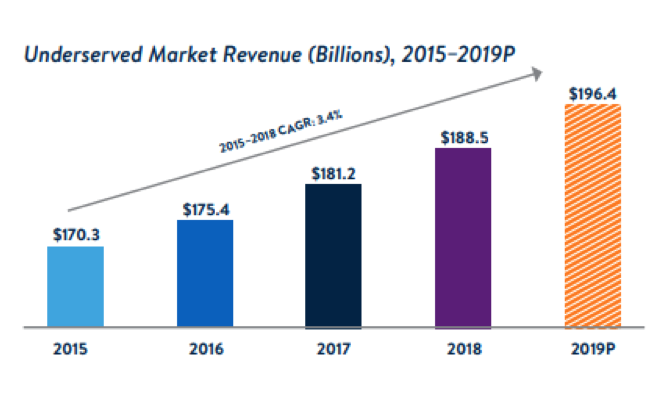

I’m not talking about this just to point out the enormity of the problem, and the opportunity. After all, capital tends to flow (in a reasonably balanced system) toward the ideas with the most potential to create wealth for the investors themselves. Here’s a crazy statistic - $189 billion is paid annually in fees and interest by financially underserved consumers in the United States.

There are a cornucopia of companies tackling the issue of high fees, lack of access to investment options, lack of option to credit options, lack of access to financial education, and more. Imagine the 2 to 3 billion people of this planet, united in common lack of access to the basic financial resources, being untethered and unleashed to create, innovate, build and inspire? The opportunity is enormous.

And it all got me thinking from the starting NYT Article. The world is absolutely changing, here and everywhere else (as is a common thread on this blog, our journeys through Latin America bear testament to the changing face of the world and the opportunities therein), and it’s not all for the worse. Hopefully these innovative technologies and ideas will unleash a new century of human ingenuity and innovation.