Do Valuations Matter?

By Arie van Gemeren , CFA – Principal @ Rising Tide VC

As a former public equities guy, I have always found the focus by most venture capitalists on valuation (especially early, early stage companies) puzzling. What does it matter if you invest @ a $10 million post money valuation, or even a $20 million post? After all – if all goes as expected, and the entrepreneurs wildly optimistic revenue charts showing gangbusters up and to the right revenue pan out as projected, you don’t care if it’s $10 or $20mm, your return is still fantastic. And that is, after all, what we are all in the business of doing – finding the next big hit.

We thought we’d prepare something high level to look @ the thought process of early-stage valuation in general. And let me preface with this – there does not seem to me to be a right answer to this question. Rather, it’s an art, not a science. There are hundreds of factors that go into thinking about early-stage valuation. I think most would agree that the valuation of a seed stage start-up is less science and more “this is what everybody else is doing in general, and perhaps the founder in this case is a serial entrepreneur who keeps winning and so the price goes up, or it’s an unattractive and uninteresting space so we’re not going to do it at a $10 million post”.

For the quantitative look . . .

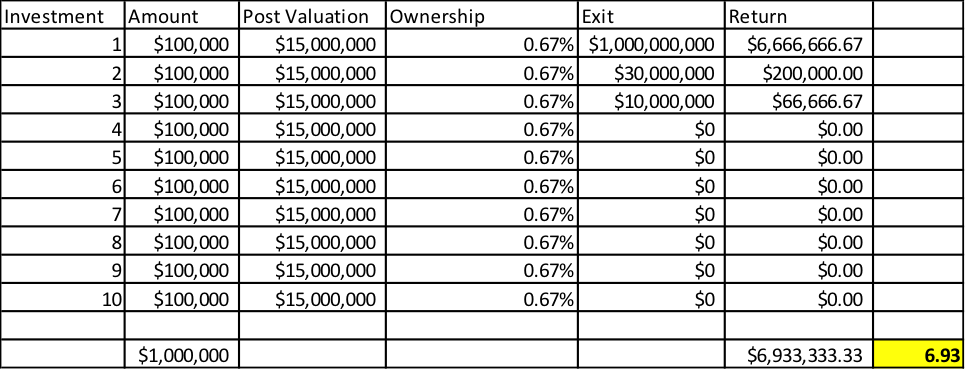

As a first look at this, I prepared a super simplified chart that looks at this (and it’s simplified as I don’t factor in dilution, fees, carry, etc.). Supposing you did a good job and you got ONE unicorn out of your portfolio of 10 companies, and you invested flatly across the board @ a $15 million post valuation, you’re sitting at a 6.93x return on equity. This doesn’t capture time value, etc., but you get the point. Not bad.

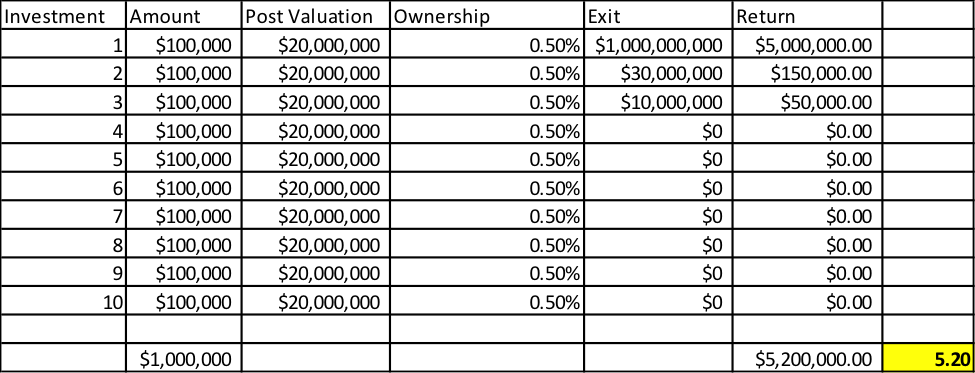

What if, instead, you invested evenly across 10 companies @ a $20 million post valuation? What’s the difference in outcome?

Still a strong 5.2x return (which, from what I know, would put an investor and Firm in the “top quartile” status), but hey – it’s almost $2 million less in total return! That’s 6.93x versus 5.20x in total return. Remember this doesn’t capture dilution – but the point remains the same. You should at least be cognizant of the difference early-valuation can make to your total return. So, there is a somewhat “mathematical” approach to the question, which decidedly results in the camp of “it does matter what your initial valuation is for total return”.

Now the qualitative – which is a huge deal as well.

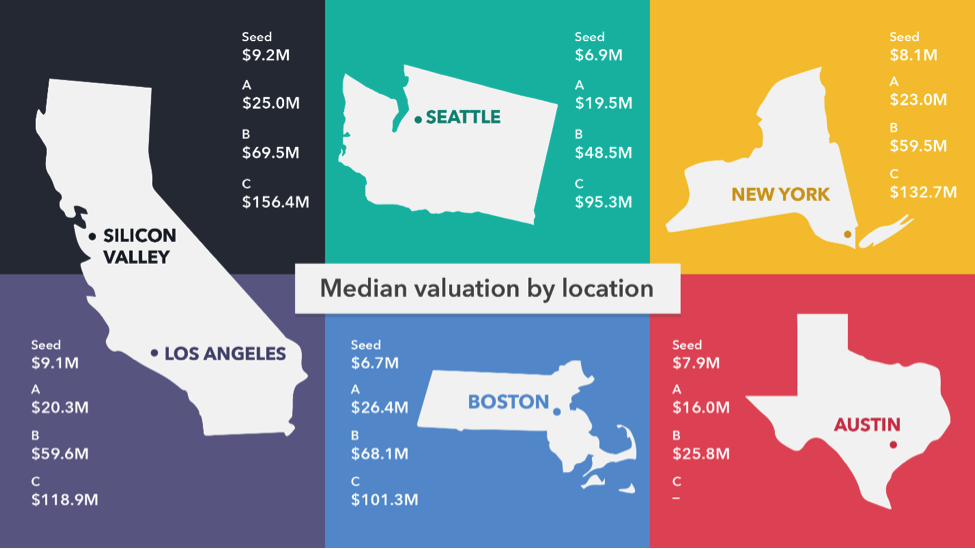

I led with that opening picture of “median valuation by location” for a reason. If the median seed stage valuation in some unnamed frontier market with war and turbulence was $1 million USD, is it a “better” deal as you could buy a lot more of the company for the same dollar figure invested? I wouldn’t think so. The odds of success for a start-up launching out of Silicon Valley are undoubtedly superior to those launching in a frontier market. The odds of success for a startup in NYC and Silicon Valley – that is harder to answer. Seed @ $8.1 million in NYC versus $9.2 million in SV is reflective more, I think, of the preponderance of capital here and competition for deals.

This leads to the next question – the perception of risk. A “riskier” startup should receive a lower valuation, all else being equal. Why? Well – at the risk of sounding ridiculous, because that’s the way financial markets are supposed to work. Money flows to a less risky investment that promises a higher return than a riskier one promising the same return (in general). It’s why you can’t earn a monster return on US Treasuries. The same dynamic somewhat exists in startups. Start-ups with proven entrepreneurs @ the helm who are proven money-makers can command higher valuations. Why? Because they are a proven commodity, investors flock to them, and the market naturally allows their valuation to float higher. Competition can do this too – if investors start believing that companies in one locale are less risky (Silicon Valley) and more capital starts concentrating there, then . . . valuations should rise. This happens in all good bubbles too, by the way, which is how risk gets skewed and people lose their shirts / faces after believing with great certainty that you could earn huge returns in US real estate and just continue to pile money into it, regardless of price.

The thing about early-stage investing, though, is that it is all risky! Proven serial entrepreneurs fail all the time. Unlike the stock market, an undiversified startup portfolio could literally lose 100% of your money. So, I would argue, a difference between NYC @ $8.1 million for seed, and $9.2 million in Silicon Valley, is not really compensating an investor differently / better in NYC.

So then how to think about risk and its relationship to valuation? Perhaps a “sure thing” should command a higher valuation. To take an extreme example, what if a “start-up” business also held $100 million in real estate assets. Say . . . it was a real estate business that had come up with this super innovative property management tech solution and wanted to raise money, and for whatever reason the founder was raising capital via this mechanism but had this real estate in it. The floor would be $100 million for the valuation, right? Because there’s real and existing assets there – and then the remainder would be whatever you think the “idea” is worth.

And what if it’s “just” an idea? Then it’s about what the marketplace of “ideas” is worth, generally, and what you think the “risk” of that investment is. And what you think and what the company gets may diverge quite widely. What other buyers are willing to pay may diverge from what you are willing to pay. However, there is a “market price” for “just an idea”, and that’s usually set by what the market thinks it’s worth. And in periods where valuations rise, it doesn’t necessarily mean that you’ll lose more money since whatever you put in is what you put in (if you invest at a $1mm post money and a $10mm post money, and in each case, you invest $100k, and the company goes belly up . . . you still only lost $100k), but it does mean that your prospective returns could be lower. In other words, you’re getting less compensated for risk.

And yet – that’s why you spend quality time evaluating the business. Is it an incremental improvement type play where there’s an existing market, and obvious customers, and revenue and contracts ready to start flowing? All else being equal, that’s a bit less risky and perhaps the valuation is higher. If it’s an entirely new enterprise, with an unproven market and unproven dynamics and it’s unclear if the public is going to accept it . . . then maybe you’d demand a lower price / greater ownership, to compensate you for what you perceive as the greater risk of a “zero” outcome.

But here’s another crucial point. What if you were strictly valuation conscious, and avoided investing in an “over-valued” rounds in general? You were “disciplined” about it. Well, one major take-away from the above should be just how incredibly important that Investment #1 is to your total returns. And that’s how it is most of the time with most venture capitalist’s portfolios – you don’t want to miss the big wins. There’s this great read on Forbes that mentions that a strict focus on valuations would have actually screened out a host of highly performing companies such as; Square, Etsy, Shopify, Twitter, Lending club and others – all of whom had higher than average pre-money valuations compared to industry averages or medians.

Said differently, and in terms of this discussion on the thought process of valuations – perhaps those valuations were higher because investors perceived those companies to be lower risk / higher potential return, and so the valuations were bid up. That’s a super dangerous statement, because of course valuations going up across the board doesn’t mean things are less risky. But but but … it is possible that starting a small business is easier today! A lot of services exist today that dramatically reduce the cost of starting a company, so perhaps there is a little bit less risk now than there was say 20 years ago.

Let me make one last point. What you pay as an investor in a company is also reflective of the value you can bring to the company. Not every investor is the same. An entrepreneur may be willing to give up more / lower the value they get for their enterprise, if the investor brings real value to the table. If I can deliver contracts and real revenue to a company, and another investor only brings money, it stands to reason that I can negotiate a better deal for myself. After all, early contracts and contacts are valuable / “valueless?” for reducing the risk of the company.

All of which is to summarize as this: there’s no exact science here. You could get a screaming deal and the company fails anyways and you lose 100% of what you invested. You could dilute the owner too much that they lose incentive to try and the whole thing topples over when the founders get distracted by other more exciting (lucrative) projects for themselves! You could pass on that super over-valued startup that ends up being a screaming hit because – guess what? – people were right, and it was exciting and had huge prospects for the future. But you could also get sloppy and not make your case for valuation from the perspective of being disciplined about it and end up missing out on returns for your LPs and for yourself. A founder could get preoccupied with preserving their equity and pass on the investor / team that could have really aided their business in return of pure financial considerations, and that could be the thing that prevents them from getting the deal which allows them to raise a super successful Series A, B, or whatever.

Valuation, then, is often in the eye of the beholder. And it’s important, but it’s also important to not kept swept off your feet by the particulars. Great opportunities can sometimes have high initial valuations – thus it’s important to do your homework, do your analysis, understand where the market is at and stick to your guns. For founders – don’t get too focused on valuations, instead focus on getting the right investors, closing business and putting yourself in the best seat for successful future raises.