FinTech in LatAm

We’ve spent this entire week in Mexico meeting with major family offices, and seeing as I started last year’s blog post series with a post on LatAm and the Emerging Markets it seemed fitting to revisit that theme this time around.

There’s a lot going on in the region. Technology holds the promise to uplift and deliver millions of people from crippling poverty rates, from the lack of access to proper financial products, to deliver educational resources to many, and to alleviate the shortage of highly qualified doctors in rural areas. Our firm is not an “impact investor” per se, nor do we have a true social angle to the work we do, and yet companies we have invested in can and will likely create lasting impact for communities such as these. Take eXo Imaging, a company that creates a hand-held ultrasound device which can be used in rural areas and in the field to deliver ultrasounds to expecting mothers, and has a plethora of other awesome uses.[i]

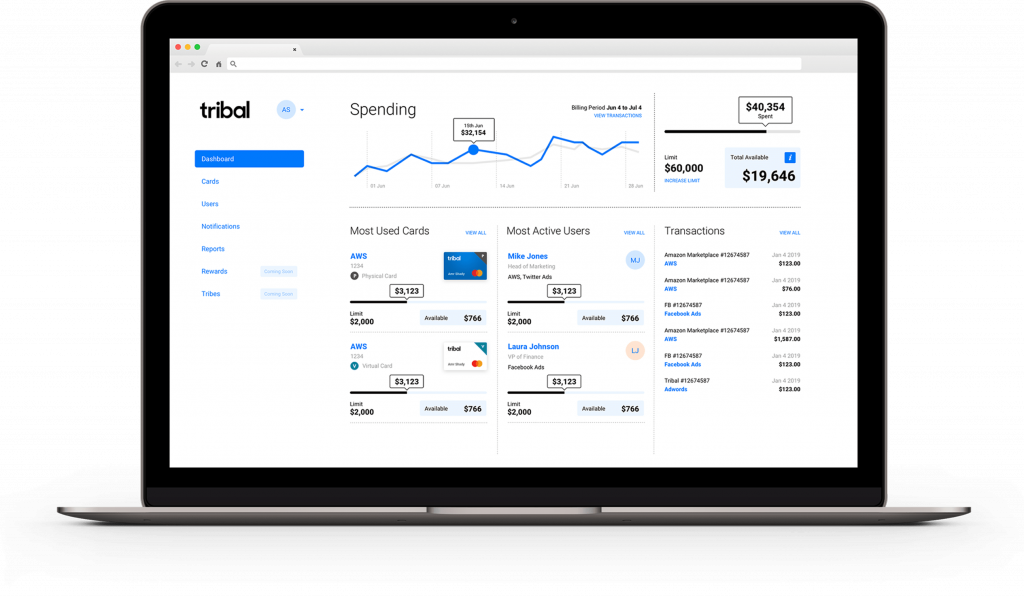

Or take Tribal Credit, which enables access to financing and credit for startups in the Emerging World. In many, many conversations down here, it has become apparent that it is all but impossible for startups to gain access to these resources. We think that this is more than just a capital(ist) good – if you consider the below, you’ll see that financing and helping startups in the region has the potential to create an enormous benefit for the people of this country and others.[i]

Debt Reduction

Unlike in the US, there is no “usury” law per se in Mexico. As such, interest rates (or “tasas of interesa”) in Mexico are usually extremely high (especially by American standards). We’ve seen some awesome companies working on debt reduction services or new ways to help alleviate debt loads. Financial education plays a huge role in this as well. Many organizations in LatAm will do POS Lending to consumers, and then the consumer is not aware of either how high their debt interest rate is, or that there are better options. This will change, soon, and is a huge societal good as well.

Credit for SMEs

Access to credit for SMEs is almost nonexistent. As previously mentioned, our portfolio company Tribal Credit is seeking to change that for startups, and there is a much larger world of companies trying to work on this. Goldman Sachs, as well as other major US Institutions, have gotten involved. CrediJusto is one awesome example of a company that is helping deliver credit to SMEs to enable them to grow. Again – this is a capitalist good, per se, but also a societal one. Without access to credit, SMEs cannot grow like they do in the US, and therefore cannot create jobs for people.

Investment Options

There is a serious lack of optionality for people to invest in the stock market in Mexico and elsewhere. This has multiple effects. For one, the Mexican stock exchange is not deep fro ma liquidity or buying power perspective, especially when compared to the US. The US, by contrast, has some of the deepest, most liquid, and active public markets around. The sum effect? Going public is a totally viable means of achieving capital to further grow your business. In Mexico, many high-quality startups aspire to go public on the US Stock Market. The double sum effect here is the Mexican people don’t have access to the inspiring and interesting businesses their own country is developing. The “triple” effect is that the growth that one can achieve via stock market investments is actually not available to most people. The opportunity here is big to provide low cost access to stocks and ETFs through discount brokerage models, or through models like Robinhood. Currently a fairly large commitment of cash is required to even open an account.

Some potentially false thematics …

Mobile Banking

Mexico has an incredibly high mobile penetration rate, and really low banking penetration rates. There are multiple startups int his ecosystem trying to tackle this issue and provide digital / mobile first banking for people. We had an interesting conversation in Guadalajara earlier this week on this exact topic. This is a great example of how/why American investors can get harmed when they come into foreign countries and try to invest. Statistically speaking, this should be a home run. What’s missed is this. In many rural parts of the country it is almost entirely a cash-based economy. There is typically not great access to a bank, either, to actually withdraw your cash. And thus the question for people becomes – do I put my money in a bank, and then have to drive 30 minutes to retrieve it?

Mobile Payments

In the same vein as above, high mobile penetration rates and low banking rates seems to imply an opportunity to go digital and advance mobile payments. I haven’t looked into this deeply, however my understanding is that Mexico has the same problem as the US. Card payments are exceedingly easy. In countries around the world where card payments were not prevalent, mobile payments were able to take off (after all, mobile payment is easier than cash)! However, the uplift of efficiency to pay by phone versus by card is not as big, which explains both the slow rate of growth in the US and in Mexico.

Real Estate

This one truly boggles my mind, and is fascinating. To explain – Mexico does not have an MLS as the United States does. This has all manner of knock on effects. Without an MLS, there is no public database of sales, and so you cannot conduct comparable sales analysis. No comparable sales analysis means that it’s difficult to assess the value of properties, which means that refinancing loans is really hard. I’ve had multiple conversations with folks in Mexico who have told me that getting a refinance is exceedingly difficult. The reasons why this is a HARD problem to solve ,though, are many. For starters, privacy in Mexico is a huge issue. Nobody wants people to actually know where they live, nor what their home is worth. In addition, transparency of pricing influences taxes (in the wrong way for most people) and os there is an embedded interest in keeping these things hidden. Lastly, no MLS means that real estate agents have a monopolistic level of control over information, and of course prefer it this way. In other words, there are some deeplyingrained and deeply difficult problems to tackle before one can break this open. It’s a great example of a false thematic – to my American ears and mind, it seemed like a huge and awesome problem to solve. But digging in deeper, you can see that it would be a minefield to cross.

In sum, there are enormous opportunities in the Emerging World. We, as Rising Tide, do not yet invest in startups directly int his ecosystem. However, a huge focus for us is developing incredible partnerships with major operating families in LatAm, MENA, Asia and Europe and then helping our companies expand into these markets through partnerships with the right partners. Anybody will tell you that partnering with the right person in foreign markets is crucial. We believe this, too, and given the above it should be apparent that local know-how and power is a kingmaker.

Please DM me if you want to discuss this in more depth!

[i] Disclaimers

The portfolio companies described herein do not represent all the portfolio companies purchased, sold or recommended for portfolios advised by Rising Tide. The reader should not assume that an investment in the portfolio companies identified were or will be profitable. Past performance is not indicative of future results. Investors should be aware that a loss of investment is possible.

[ii] Disclaimers

The portfolio companies described herein do not represent all the portfolio companies purchased, sold or recommended for portfolios advised by Rising Tide. The reader should not assume that an investment in the portfolio companies identified were or will be profitable. Past performance is not indicative of future results. Investors should be aware that a loss of investment is possible.