Has Disintermediation Overplayed its hand?

Disintermediation – in all industries – is moving forward at breakneck speeds. Take my own industry – finance – and you don’t have to look far. We’re moving away from active traded funds, away from stock trading, away from brokers, away, away, away. There are already a plethora of startups working on tackling issues like – getting rid of real estate agents, disintermediating financial advisors, disintermediating insurance agents, and a lot more.

And a lot of this has been to the common benefit of mankind. I mean take the move away from actively managed mutual funds. It’s been of great benefit to most people (except for, I guess, the active stock pickers) to give people low fee options. It’s been great for retirement savings to allow people to invest in the “growth of America”, if you will, and collect that upside. We know a lot about this, and it’s without doubt been a great change. Or take the reduction in trading costs – when the NASDAQ came into being and trading became less and less cumbersome, why should the trading costs and fees have remained so high? Well … they didn’t. This, too, is a form of disintermediation. We used to require Fidelity, or your broker, to execute a trade on your behalf. It used to be quite difficult! And now it isn’t … and except for a few highly paid brokers, that’s mostly to our benefit.

However, I’m going to take the contra-point here. There is such a thing as going too far. No, I’m not saying trading fees are important or good. However, I am saying that human advice is good, and I am hard pressed to contemplate ways that an AI, no matter how sophisticated, can replace this. Let’s think of why.

First – we are a social / tribal species. The need for assurance from other members of the tribe is with us, for better or for worse. Yes, there are some who don’t need it. Good for them. But the majority do. A lot of people need reassurance and empathetic advice coming from somebody who both knows them and seems like they possess the requisite wisdom to qualify as an “advice-giver”. The way in which advice is compensated will very likely change, but advice itself will remain valuable.

Second – in times of distress, even more-so, people rely on social support. Thus, envision a severe bear market and an elderly retiree worrying about their finances. They are unlikely to turn to a computer or an AI, no matter how sophisticated, for reassurance during this time. They will likely want a steady hand, experience, and empathy for their situation. Some things can be replicated by email, text or AI, but some can’t. I don’t have data for this, but I’d argue that any non-human interaction (with current technology) is unlikely to dot he trick.

Third – some products (like life insurance) simply require a sales person to actually get them done. Waking up one day and deciding to buy life insurance is not something that an ordinary person makes. We’ve invested in a few companies in this space, and I can tell you – a sales person is needed to consummate a life insurance sale. There’s a reason that DTC Platforms for life insurance just haven’t taken off – people need to be pushed to buy something they will literally never see, and hope they’ll never use.

Last – I really think that, for large enough transactions, disintermediation is a LONG way off. Which is to say, I don’t think real estate agents are going anywhere.

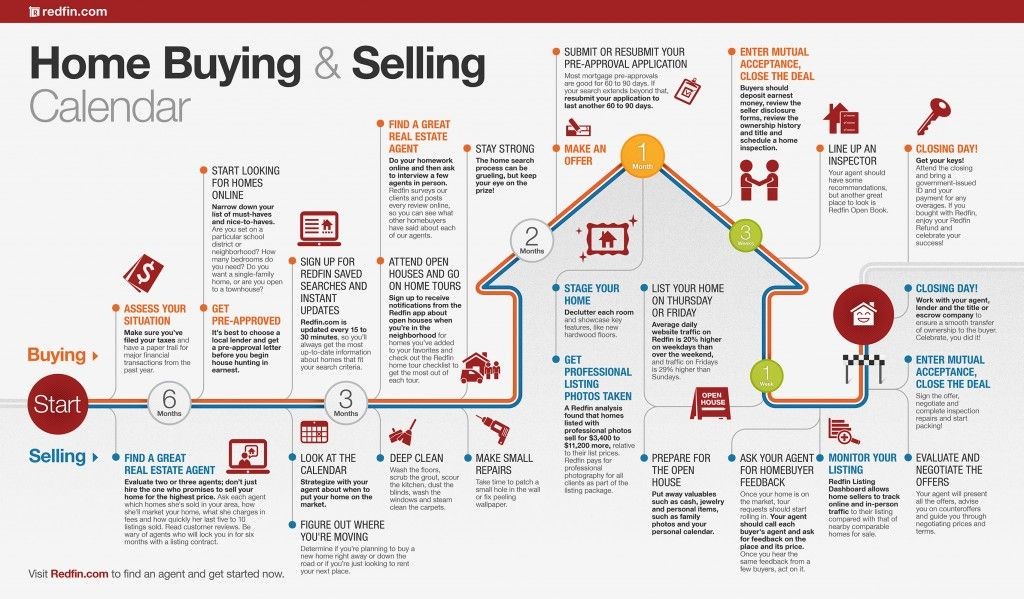

The above feels over-complicated, maybe because it is. Also, how often do people buy or sell a home? I have personally purchased multiple properties (single family and investment) and can tell you one thing – I still would prefer to use an agent in 100% of the situations. There is a LOT involved in buying or selling a property. There is a LOT of emotion involved. There is a ridiculous amount of paperwork.

Yes, there are investors in real estate who prefer to not use agents. I know a few! But how many normal Americans buy and sell hundreds of homes in their lifetime? Not many. Most do it 2-3 times, at most, in their lives.

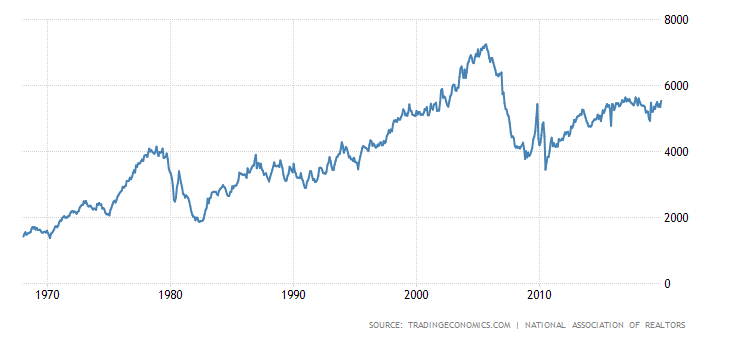

Existing Home Sales in Millions

Or said differently, between 5 to 6 million existing homes are sold (and bought) in the United States per year. From a population of 327 million that means that ~ 2% of the population participates per year in buying or selling an existing home (yes – the number might be higher if you exclude children, impoverished families who don’t usually transact in real estate, etc.).

So – my thesis is this – if you transact in real estate at most once, maybe twice – three times in your lifetime (starter home > dream home > retirement home) and each time it involves a huge percentage of your net worth, I Just don’t imagine that you’re going to not use real estate agent Susie who sells all the homes in your neighborhood and with whom you know you won’t mess up and lose a ton of money. Even real estate agents use other real estate agents a lot of the time!

In sum – here’s my thesis. Disintermediation has done a lot of good for the world, and for society. I think disintermediation takes a different turn. I think the value of good “advice givers’ will never go away, due to our unique nature as a species, and instead our “advice givers” will become better armed and equipped to serve their clients in the future. But regarding those real estate agents – I would bet their commissions will start coming down. Just a hunch.