The Lean Startup and Assumption Analysis

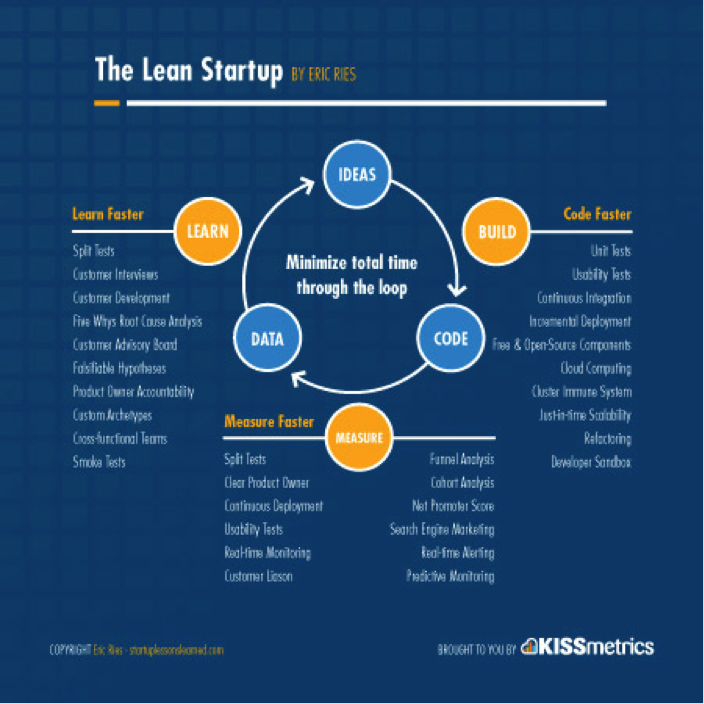

I recently read The Lean Startup, which is a crucial read for anyone interested in building or investing in early-stage companies (in my opinion). If you haven’t read it, read it. At the core of the book is this concept of building lean, testing quickly (A/B testing all solutions), not batching updates but rolling them out continuously and constantly engaging in what the author calls “Innovation Accounting” (and a LOT more). Basically – the process of building a startup is more about a management process of constantly gauging market feedback and tweaking as necessary. And then, pivoting or persevering (one of the toughest gut checks for entrepreneurs & investors alike).

Anyways – while it’s a fantastic read for how to build and run a startup, it also raised some amazing thoughts for me on the process of analyzing and investing in companies. Namely – naming and questioning the core assumptions behind the business. The author identifies two primary assumptions that all businesses have. These are; the VALUE ASSUMPTION and the GROWTH ASSUMPTION.

Now, the point of these two highlights in the book is that these are areas that the founding team needs to be constantly testing. I.E. is my value assumption working, and tested and tested repeatedly via A/B testing, product rollout, and more, to ensure that consumers are getting the value that your model assumes. Of course, your model will likely be changed dramatically from your coffee / happy hour conversation with your co-founder to the point that the business becomes viable. That’s the point of the testing phase.

The same goes for your Growth Assumption. How do you assume the business will grow? Will it be a viral growth play, launched via Instagram hashtags that will spread rapidly? Will you provide discounts / bonuses to referrers to add more members to your business, and/or is it a land and expand strategy that will first gather one engineer, then another, and quickly steamroll its way up to management?

From my days as an equity research analyst, it was always drilled into our heads to “use metrics accountability”. In other words, feeling that something is working is inadequate. You must prove it with metrics, or it’s nothing. “Metrics accountability” is a weighty term, and it basically means to test and understand everything – literally everything – via metrics.

So, by aggregating these above points, businesses can in some sense boil down to these two assumptions and the metrics that either prove or disprove them. What is the perceived “value” you assume your consumers will get, and what is the theorized “growth” mechanism that the business is going to take off on?

Thus, from a diligence standpoint, I’ve really found it helpful to boil things down to their basics (more generally – I am a big believer that we [the royal we] overcomplicate things to our own detriment). Something as simple as;

What’s the value you believe your consumer is getting here, and how can you prove it with metrics?

Then, of course, if you’ve invested in the company, it would make sense to continue pushing and challenging this assumption. You might ask – what was the original perceived value, and what have we been learning from customers that challenges this assumption or changes the perceived assumption? But at a baseline, I think we are all investing in companies based on what we perceive to be the value. Better yet to question this assumption, and look into market feedback on if that value is actually being delivered.

Which leads us to the second, equally important assumption.

What do you believe is the mechanism for growth (your assumed growth model), and how can you prove that it’s working with metrics?

The result of these questions may or may not be an investment decision, but I think it provides a much stronger framework for making an investment decision. And of course, an investment decision for a venture capitalist comes down to both your first check, your continued investment of time, and the subsequent decision to continue backing the company (or not). As such, this above process can and should be repeated endlessly – for both your own good, and that of the entrepreneur’s company.