The Power of AI to Optimize Portfolio Profitability for Financial Institutions

By Brent MacDonald – Principal @ Rising Tide VC

Senso.ai is an “Analytics-as-a-Service” platform that can deliver high-confidence predictive notifications to financial institutions to service, price and obtain consumer loans, and to adapt to market conditions with no technical barrier. Its cloud-based infrastructure generates predictive insights about consumer portfolios which continuously improves over time. The Company’s technology has broad applicability across lending products, including mortgages, credit cards, Point of Sale (POS) lending, automotive and student loans. The platform for example provides data on maximizing retention and cross-sell across mortgage balances, client contact recommendations for early renewal period, recommendations to prevent midterm attrition, and turn loan-to-value into life-time value.

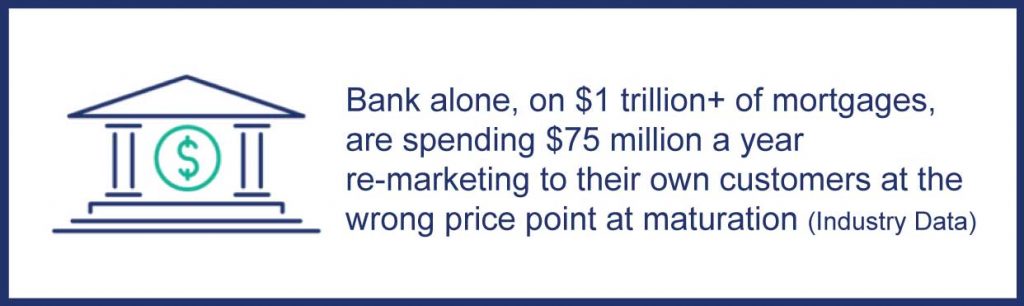

Mortgage retention rates in the U.S. average less than 20 percent, according to a Black Knight report. By embedding Senso.ai’s technology into a financial institutions’ marketing and sales workflows and broadly applying it across lending products, clients can get that average up to 80 percent retention.

The broader thematic at play in the banking world is (a) encroachment of fintechs on their traditional turf, and (b) the very real threat of encroachment from major tech players (e.g. Amazon, Apple) into the banking world. The end result of this has been a steady decrease in banking margins, as they are squeezed on two sides – fintech banking startups and traditional tech companies. Senso.ai can develop a much more complete view of the customer, and customer behavior, than banks can.

Beyond this, there is another unique value that Senso.ai can bring to major banks which is not even a major business arm for them yet (but will be in the future). Many banks are active secondary buyers (or sellers) of loans, and more specifically of loan pools. Senso.ai is able to help them analyze loan pools much more effectively, which could enable banks to make significant returns on finding and buying undervalued pools of loan assets.

Senso.ai’s Series Seed II was led by Mendoza Ventures and includes participation from Breakaway Growth (Silicon Valley), Luge Capital (Toronto), Rising Tide (Silicon Valley) and Inovia (Toronto).

Read the full press release here.

Rising Tide Fund Managers, LLC and its affiliates (“Rising Tide” or “We”) is a United States venture capital firm investing primarily in the information technology and healthcare / life sciences markets. Over the last 35 years, we have partnered with family funds, high-impact investors, and strategic partners to help launch and expand startups in a variety of industries across three continents.

dedicated to cooperating with our entrepreneurs at all stages: from financing to leveraging our international networks to facilitating exits by design. For more information, visit www.rtf.vc.

The portfolio companies described herein do not represent all the portfolio companies purchased, sold or recommended for portfolios advised by Rising Tide. The reader should not assume that an investment in the portfolio companies identified were or will be profitable. Past performance is not indicative of future results. Investors should be aware that a loss of investment is possible.